La Mesa Real Estate Trends: Lock-In Effect Is Fading

La Mesa Real Estate Trends: Lock-In Effect Is Fading

For the first time in years, more U.S. homeowners hold mortgages at 6%+ than under 3%—and that matters for La Mesa real estate trends and the broader East County market. The “lock-in effect” that kept owners glued to ultra-low rates is loosening. More people are moving anyway, even if it means taking a 6% handle.

In practical terms, this is how you get more listings, more churn, and a market that feels less “stuck.” For buyers in La Mesa, El Cajon, Spring Valley, San Carlos, Del Cerro, and Tierrasanta, that’s the first real path back to selection without needing a full-blown price correction.

The lock-in effect is fading—and inventory follows

The lock-in effect was simple: homeowners with 2–3% mortgages didn’t want to trade that payment for a 6–7% payment. So they stayed put. That choked listing inventory and kept prices stubbornly high.

What’s changing now is psychology and math.

-

A growing share of homeowners already have 4–6% mortgages (and now plenty have 6%+).

-

The “pain” of moving is lower when you’re not giving up a once-in-a-generation rate.

-

Life events don’t wait: kids, divorce, job changes, caregiving, downsizing.

In other words, more households are deciding, “We need a different house,” instead of, “We’ll wait out the rate.” That’s the crack in the dam that buyers have been waiting for.

Why this is actually good news for buyers in La Mesa and East County

Buyers don’t need rates to drop back to 3% to regain leverage. They need options.

As rate lock-in fades, the market can normalize in three ways that matter locally:

-

More resale inventory

Even modest listing growth changes negotiating dynamics—especially in neighborhoods where buyers used to fight over the one decent home that hit the market that week. -

Less upward pressure on pricing

More selection doesn’t automatically mean prices fall. It often means prices stop running away. That’s a meaningful shift for affordability in East County. -

Better fit purchases

When inventory is tight, buyers “settle.” When inventory improves, they buy closer to the right school boundary, lot size, layout, or commute pattern.

That last point matters in places like San Carlos and Del Cerro, where buyers are extremely specific about schools, street appeal, and neighborhood feel.

What it means neighborhood-by-neighborhood

Not every submarket reacts the same way to loosening lock-in. Here’s the practical read across your target areas.

La Mesa: more move-up and downsizing activity

La Mesa tends to see both life-stage moves (bigger/smaller homes) and longer-term owners with meaningful equity. As more owners accept 6% mortgages, expect:

-

More “I’m finally ready” listings from owners who waited two years.

-

More move-up buyers who sell in La Mesa and buy nearby for space.

-

Strong demand still, but with more room for inspection and appraisal negotiations.

Watch: homes near village-style amenities and strong school pockets. Those will stay competitive even as inventory improves.

San Carlos: selection improves, but pricing stays disciplined

San Carlos buyers often want a specific box checked: schools, lot size, quiet streets, pride of ownership. If selection increases, buyers become pickier fast.

-

Better homes still command a premium.

-

“Almost updated” homes may sit longer.

-

Sellers will need cleaner pricing and stronger presentation.

Actionable angle: If you’re listing in San Carlos, pre-inspections and clear upgrade narratives matter more when buyers have choices.

Del Cerro: move timing matters more than rate timing

Del Cerro is a “trade-up” neighborhood for many households. When families outgrow a smaller home, they move—even if rates aren’t ideal.

As lock-in fades:

-

Expect more families choosing payment comfort over rate perfection.

-

Expect buyers to focus harder on monthly payment strategy (buydowns, credit, ARM vs fixed, refi plan later).

Agent takeaway: frame affordability around payment tools, not rate headlines.

El Cajon and Spring Valley: more sensitive to monthly payment

These markets are often more payment-driven, which means shifts in inventory and rate expectations can change buyer behavior quickly.

-

When listings rise, buyers regain the ability to negotiate.

-

Condition becomes a bigger pricing factor.

-

Investor activity can return selectively if deals pencil.

What to monitor: days on market and the spread between list price and sales price. Those are the earliest signals that leverage is shifting.

Tierrasanta: steady demand, but fewer “panic offers”

Tierrasanta tends to behave like a stable, family-driven pocket with consistent demand. As inventory improves:

-

Strong homes still move.

-

Buyers are less likely to waive protections.

-

Sellers who overprice don’t get rescued by scarcity.

Best move: price to the market on day one. “Test pricing” becomes expensive when buyers have alternatives.

California’s second lock-in: Proposition 13 is still a factor

Even as mortgage lock-in weakens, California has another anchor: property tax lock-in under Proposition 13. Long-term owners often have extremely low tax bases compared to today’s purchase prices.

That keeps some owners in place even if they can handle a higher mortgage rate. It’s a real friction point in La Mesa and the surrounding neighborhoods where owners have held for decades.

What this means locally:

-

Some inventory will return, but not all of it.

-

Tax considerations remain part of the seller decision tree.

-

For certain owners, moving isn’t a rate question—it’s a tax reset question.

If you’re advising sellers, this is where a net sheet with realistic tax assumptions can make (or break) the decision to list.

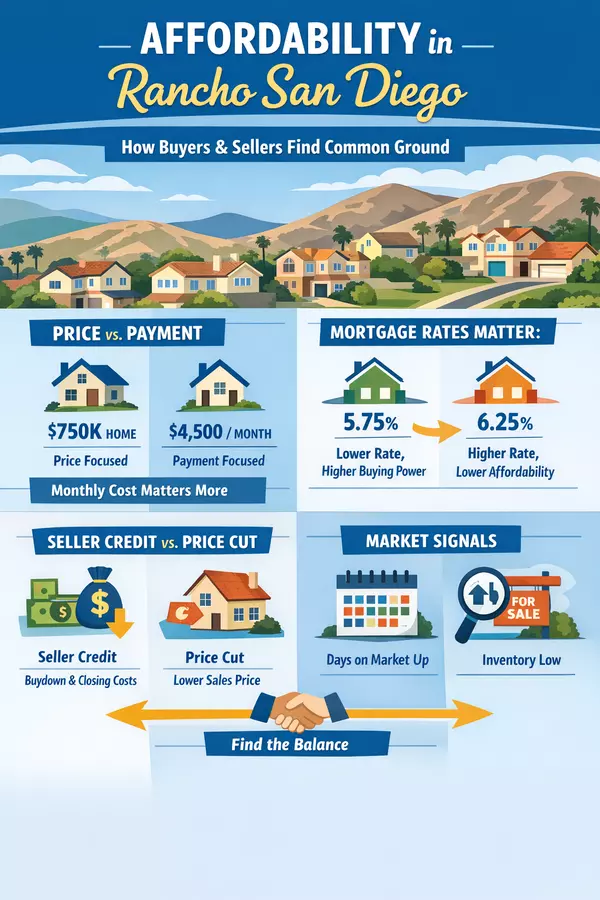

The “6% world” changes how buyers and sellers negotiate

When 3% rates were common, sellers could be stubborn because they didn’t need to move and buyers had fewer options. In a market where 6%+ mortgages are normal, expectations reset.

What buyers start doing more often

-

Asking for rate buydown credits (temporary or permanent).

-

Negotiating repairs instead of accepting “as-is.”

-

Using contingencies strategically again.

-

Comparing multiple homes instead of bidding blindly.

What sellers need to accept

-

The buyer pool is still there, but it’s more payment-conscious.

-

Condition and pricing matter more when inventory rises.

-

Concessions aren’t “weak.” They’re often the difference between a contract and a stale listing.

Here’s a simple comparison you can use in client conversations:

| Market Condition | Buyer Behavior | Seller Strategy That Works |

|---|---|---|

| Tight inventory, heavy lock-in | Fast offers, fewer protections | Price firm, lean on scarcity |

| Inventory improving, lock-in fading | More comparison shopping | Sharp pricing + clean presentation |

| Payment-sensitive demand (common in East County) | Credits/buydowns requested | Budget for concessions upfront |

Practical strategy for 2026 buyers in La Mesa and nearby

If you’re buying in La Mesa, El Cajon, Spring Valley, San Carlos, Del Cerro, or Tierrasanta, the playbook is changing—slightly, but meaningfully.

-

Shop the payment, not just the rate.

Credits, buydowns, and refinance timing matter more than “winning” the rate today. -

Prioritize homes that are hard to replace.

Corner lots, true view corridors, school adjacency, and functional layouts hold value even when the market normalizes. -

Use inspection leverage correctly.

When inventory rises, buyers can negotiate. But the cleanest wins come from being reasonable and specific.

Practical strategy for East County sellers

If you’re selling in these areas, the opportunity is real—but you don’t get 2021 rules anymore.

-

Price for today’s payment reality.

Buyers can afford less principal at higher rates. Overpricing won’t get bailed out by scarcity as often. -

Control the narrative on condition.

Pre-inspections, clear disclosures, and targeted repairs keep deals together when buyers have choices. -

Assume credits will come up.

Build concession flexibility into your pricing strategy instead of reacting defensively mid-escrow.

Bottom line: this is how the market gets unstuck

The headline isn’t “rates are high.” The headline is that high rates are becoming normal, and that normalization reduces paralysis. That’s why this shift is positive for La Mesa real estate trends and the adjacent East County neighborhoods.

More homeowners moving means more listings. More listings means more selection. More selection brings a more balanced negotiation environment—without requiring a crash.

Find Out What Your Home Is Worth Instantly HERE:

FAQ: La Mesa Real Estate Trends and the Fading Lock-In Effect

Q1: What does it mean that more homeowners have 6%+ mortgages than 3% mortgages?

It means the ultra-low-rate crowd is shrinking. More owners already have “normal” rates, so fewer feel trapped. That loosens inventory and increases turnover—especially for move-up and life-change sellers.

Q2: Does this mean home prices in La Mesa will drop?

Not automatically. More listings usually reduce upward pressure and cool bidding wars. In La Mesa, San Carlos, Del Cerro, Tierrasanta, El Cajon, and Spring Valley, price direction will hinge on inventory growth, condition, and buyer payment sensitivity—not just rates.

Q3: Are buyers gaining leverage in East County?

In many cases, yes. When selection improves, buyers can negotiate more often on:

-

Seller credits (rate buydowns/closing costs)

-

Repairs or repair credits

-

Contingency timelines

-

Price reductions on stale listings

Q4: Should I wait for rates to drop before buying?

If you’re waiting for 3% again, you could be waiting a long time. A better approach is to run a payment strategy: compare (1) buying now with credits/buydowns vs. (2) waiting and competing if rates fall and demand spikes.

Q5: What’s a rate buydown, and does it actually help?

A buydown is when the seller (or builder) credits funds to reduce the buyer’s interest rate—either temporarily (common) or permanently (less common). It can meaningfully lower the payment early on, which helps buyers qualify and feel comfortable.

Q6: How does Proposition 13 affect La Mesa and nearby neighborhoods?

Prop 13 can keep long-term owners “locked in” through low property taxes, even if they’re willing to accept a higher mortgage rate. That can limit inventory in areas with many long-held homes, which includes parts of La Mesa and adjacent communities.

Q7: Which neighborhoods feel rate changes the most—La Mesa vs. El Cajon/Spring Valley?

Generally, El Cajon and Spring Valley tend to be more payment-sensitive, so shifts in rates and credits can move demand faster. San Carlos, Del Cerro, and Tierrasanta often behave more like “fit-driven” markets where layout, street, and school boundaries can outweigh rate noise.

Q8: If I’m selling, should I offer concessions now or hold firm?

If your home is turnkey and priced tight, you may not need much. If you’re competing with multiple similar listings—or your home needs updating—planned concessions (credits/buydowns) often outperform price cuts because they directly address monthly payment concerns.

Q9: What’s the biggest mistake buyers make in a 6% mortgage environment?

Focusing only on the interest rate and ignoring:

-

Total monthly payment strategy

-

Inspection leverage

-

Resale fundamentals (layout, lot, location, schools)

-

The cost of waiting (rent + missed equity + competition)

Q10: What should I watch in La Mesa real estate trends over the next 60–90 days?

Track these weekly:

-

Active listings and new listings

-

Days on market by neighborhood

-

Price reductions

-

Concession frequency (closing cost credits, buydowns)

-

Sale-to-list price ratio

Chris Melingonis - The Realtor Dad / La Mesa Realtor

With almost two decades of experience in the real estate market, I have dedicated my career to helping families buy and sell homes in La Mesa and San Diego, California. My extensive knowledge of the local market allows me to provide valuable insights and guidance, ensuring my clients feel confident and informed throughout the entire process. I understand that real estate transactions can be daunting, which is why I prioritize education and clear communication to help my clients navigate even the most challenging situations.

My unique marketing plan is designed to get homes sold quicker and at maximum value. By leveraging cutting-edge technology and innovative strategies, I showcase properties in a way that attracts potential buyers and stands out in the competitive San Diego market. I am committed to using my experience to tailor my approach to each client's specific needs, ensuring a seamless experience from start to finish.

Whether you are a first-time homebuyer or looking to sell your cherished property, I am here to guide you every step of the way. My focus on building lasting relationships and providing exceptional service has earned me the trust of many families in our community. Together, we can make your real estate dreams a reality.

Recent Posts