San Diego Housing Affordability Is Shrinking The Kid Count

San Diego Housing Affordability Is Shrinking The Kid Count

San Diego County’s share of children under age 5 has dropped sharply—down from 7.8% in 2005 to 5.4% in 2024—and Axios points directly at what most agents hear in real conversations: housing and child care costs are changing family decisions. Axios

This isn’t just a demographic footnote. It’s a demand signal. When fewer young families plant roots, the ripple hits school enrollment, neighborhood turnover, rental mix, and the type of housing that sells fastest in different parts of the county. Axios

The numbers: under-5 share fell to 5.4% in 2024

Axios’ breakdown is blunt:

- San Diego County’s under-5 population share fell 2.4 percentage points from 2005 to 2024 (7.8% → 5.4%). Axios

- That decline is larger than the national drop (down 1.6 points over the same period). Axios

- Public school enrollment countywide has also declined—Axios cites about 27,000 fewer students over the last decade. Axios

In real estate terms: this is evidence that “family formation” is getting harder here. And San Diego housing affordability is part of the why.

Why San Diego housing affordability is pushing families to pause—or leave

Buyers don’t experience “cost of living.” They experience monthly burn.

Recent local reporting tied to housing and child care costs shows how tight the math has become:

- Average rent cited in a regional housing report was $2,571, with an estimated need to earn about $50/hour to afford it. ABC 10 News San Diego KGTV

- YMCA data cited by Axios put average monthly child care center costs around $1,650 for infants and $1,200 for preschoolers (neighborhood-dependent). Axios

- Another local report discussed alongside those costs found 190,000 children lack access to licensed child care, and estimated a family of four needs $107,000+ annually to afford care. ABC 10 News San Diego KGTV

Put that together and you get a predictable behavioral shift:

- couples delay kids,

- households choose smaller homes longer,

- move-up timelines stretch,

- and some families trade San Diego for affordability in Temecula/Murrieta, Riverside County, parts of Arizona, or wherever their job flexibility allows.

That’s not ideology. That’s underwriting.

Market implications: what fewer young kids changes in San Diego real estate

This demographic trend doesn’t mean “housing demand collapses.” It means demand rebalances.

1) Family-sized homes face a different buyer mix

In school-driven neighborhoods (think Carmel Valley, Del Mar Heights-adjacent, parts of Poway, 4S Ranch, La Mesa, San Carlos, Scripps Ranch), the buyer pool often includes:

- dual-income professionals with one child instead of two,

- older move-up buyers with fewer school years left,

- and multigenerational households solving affordability with shared space.

Result: layout efficiency and flexibility matter more than ever—extra office, ADU potential, and true 4-bed function outperform “formal living room” nostalgia.

2) Schools and enrollment become a neighborhood-level pricing factor

When enrollment declines, districts may consider program cuts or consolidations over time. Axios notes how funding pressures can follow fewer students. Axios

You don’t need to predict a closure to price risk. You just need to recognize that:

- school stability becomes a premium feature, and

- uncertainty can widen price spreads between adjacent areas.

3) Rentals: more long-term tenants, fewer “starter-home exits”

If households postpone buying (or buying bigger), you often see:

- longer tenancy durations,

- higher demand for 2–3 bedroom rentals near job centers,

- and strong performance for “family-capable” rentals with parking, storage, and in-unit laundry.

This supports certain small multifamily and SFR rental strategies, especially where replacement costs are high.

A quick guide: what to watch by segment

|

Segment |

What may happen |

What to track in 2026 |

|

Entry-level condos/townhomes |

More demand from child-free professionals and downsizers; affordability ceiling still real |

HOA health, insurance costs, rate sensitivity |

|

3–4BR SFR in school areas |

Still liquid, but buyers scrutinize total monthly cost and school stability harder |

Enrollment trends, district planning, comps vs. nearby alternates |

|

2–3BR “work-from-home” homes |

Wins on utility; competes well even without “kid count” growth |

Office/bonus room value, commute patterns |

|

ADU-capable lots |

Demand rises as families solve costs with rental income or multigenerational living |

Permitting realities, utility upgrades, rent comps |

|

Investor rentals |

Longer tenant duration can reduce vacancy risk, but regulation/insurance matters |

Insurance quotes, rent growth, property taxes |

What agents, sellers, and investors should do with this trend

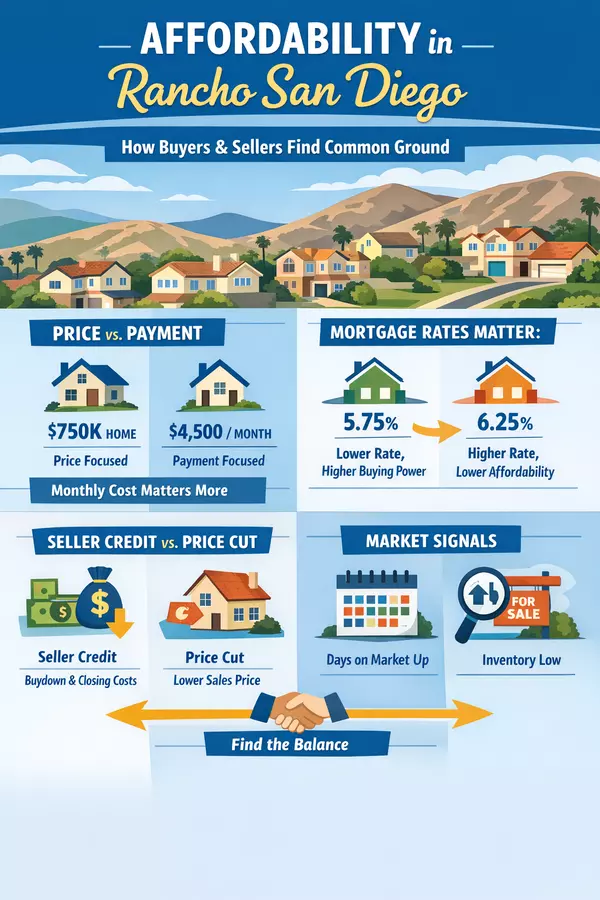

Price and position listings for “monthly payment logic”

In a market shaped by San Diego housing affordability, buyers don’t fall in love first. They run the numbers first.

- Lead with payment reducers: solar (if transferable/value-real), rate buydown options, low-maintenance improvements, and ADU feasibility.

- Call out child care and commute practicality: walkability to schools/parks, freeway access, and employer hubs (UTC, Sorrento Mesa, downtown, Torrey Pines).

For sellers of family homes: sell flexibility, not just bedrooms

“Room count” is table stakes. What moves the needle:

- separate office/guest space,

- a real dining area that can convert to homework zone,

- fenced yard + usable storage,

- and anything that supports multigenerational living.

For investors: target “family-functional” rentals

The households that are still here still need workable space. Look for:

- 2–3BR units with parking and laundry,

- SFRs with an extra room that functions as an office/nursery,

- and properties where an ADU adds income without breaking the site.

GET THE TRUE VALUE OF YOUR HOME INSTATLY HERE:

Bottom line for San Diego real estate

Axios’ child-population data is a warning light: if it’s harder to raise kids here, the market tilts toward smaller households, longer renting horizons, and more value placed on flexibility. Axios

The opportunity is for professionals who adjust early—by pricing to payments, marketing to real household use, and tracking neighborhood-level signals like enrollment and housing mix.

----------------------------------------------------------------------------------------------------------------------

Why is San Diego seeing fewer young children?

San Diego County’s share of kids under 5 has fallen over time, and local reporting points to high housing costs and expensive child care as major drivers. When the monthly budget gets tight, families delay having kids, have fewer kids, or relocate to more affordable markets.

How does a drop in young kids affect the San Diego real estate market?

It shifts demand. Fewer young families can mean:

-

more competition for 2–3 bedroom homes from professionals and downsizers

-

longer rental tenure as households postpone buying

-

more focus on flexible floorplans (office/guest room/ADU potential) than “big family” layouts

Will home values drop in family neighborhoods if enrollment declines?

Not automatically. But school enrollment trends can influence buyer psychology and price sensitivity. Neighborhoods with stable school demand tend to hold premiums better. Areas with uncertainty can see wider spreads in comps, depending on inventory and buyer mix.

What types of homes benefit from this trend?

Homes that match today’s household needs tend to win:

-

2–3 bedroom properties with a true office/bonus space

-

homes with ADU potential or multigenerational functionality

-

low-maintenance homes near job centers (UTC, Sorrento Mesa, Downtown)

Is this good news for San Diego rental property owners?

Often, yes. When buying gets harder, households rent longer. That can support:

-

lower turnover

-

steadier occupancy

-

strong demand for “family-functional” rentals (parking, laundry, storage, usable layouts)

Insurance and operating costs still matter, so underwriting needs to be conservative.

How should sellers market family homes right now?

Sell monthly-payment value and flexibility:

-

call out office/bonus room function

-

highlight ADU feasibility or multigenerational layout

-

emphasize walkability to parks/schools and commute access

-

consider incentives like rate buydowns (when feasible) instead of only price cuts

What should buyers with kids focus on in San Diego today?

Start with the total monthly number, then narrow by lifestyle:

-

commute time and job stability

-

school stability and neighborhood turnover

-

whether the home can flex (office now, nursery later)

-

options to offset costs (ADU, roommate plan, multigen setup)

Where are young families moving instead of San Diego?

Many look to nearby markets where purchase prices and child care costs stretch further—often inland areas or neighboring counties—especially when remote work or hybrid schedules make relocation realistic.

What’s the biggest “hidden” factor families underestimate?

Child care + housing together. Families often budget for a mortgage payment but underestimate the combined impact of child care, commuting, and lifestyle costs. In San Diego, that gap can change the entire buying timeline.

What data should I watch to spot neighborhood shifts early?

Track:

-

school enrollment announcements and boundary changes

-

days on market and price reductions for 3–4BR homes

-

rent trends for 2–3BR units

-

permitting activity for ADUs and additions

These indicators tend to show change before headlines do.

Recent Posts